In recent years, wine consumption in China has seen a significant rise, reflecting a shift in the tastes of Chinese consumers. Wine has become increasingly popular both as a social beverage and as a status symbol. Many Chinese people consider wine as a luxury product and a way to demonstrate their social status.

Italian wine exports to China have experienced substantial growth, capitalizing on the increasing request and interest in high-quality wine. Italy, known for its winemaking tradition, sees its wines appreciated for their quality and variety.

However, navigating the Chinese market dynamics can be complex, and Italian wineries often face challenges such as competition from wines of other countries, the need to adapt to local tastes, and the management of regulations and taxes on wine.

The Chinese government has played a role in supporting the domestic wine industry by promoting the production and consumption of Chinese wines. Nevertheless, Italian wine continues to be well-received and appreciated among Chinese consumers, contributing to its increasingly strong presence in the Chinese wine market.

Contenuti:

Rise and Decline of Wine in China

The 1980s marked the beginning of the introduction of wine to China. With the limited opening of the country to Western goods, wine made its way onto Chinese television, primarily in the form of French red wine and Champagne, often used for celebrations.

Even today, the collective imagination associates wine predominantly with red wine, but Chinese millennials and Generation Z, wielding considerable purchasing power, are reshaping the rich Chinese wine market, driving demand for other varieties such as the well-liked Italian Prosecco, especially among women.

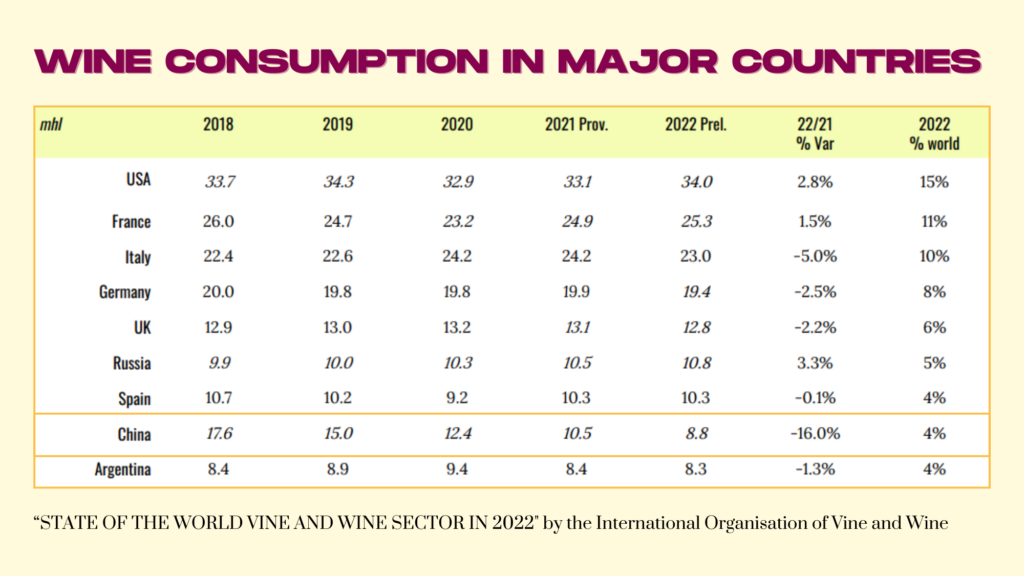

While China doesn’t rank among the top global consumers of wine, it secured the eighth position in 2022, holding 4% of the world’s total consumption. Despite significant figures, it has dropped several positions due to a 16% consumption decline.

The complete closure of the country due to COVID heavily influenced this outcome. In addition to the interruption of trade with large producing countries, wine consumption seems to have been penalized by the total lack of tourism. The demand for wine in China is concentrated in high-income mega-cities such as Hong Kong, Beijing, and Shanghai, attracting international tourists accustomed to wine consumption, along with a significant presence of Millennials and Generation Z consumers who have studied or traveled abroad and are familiar with wine culture.

Domestic Production

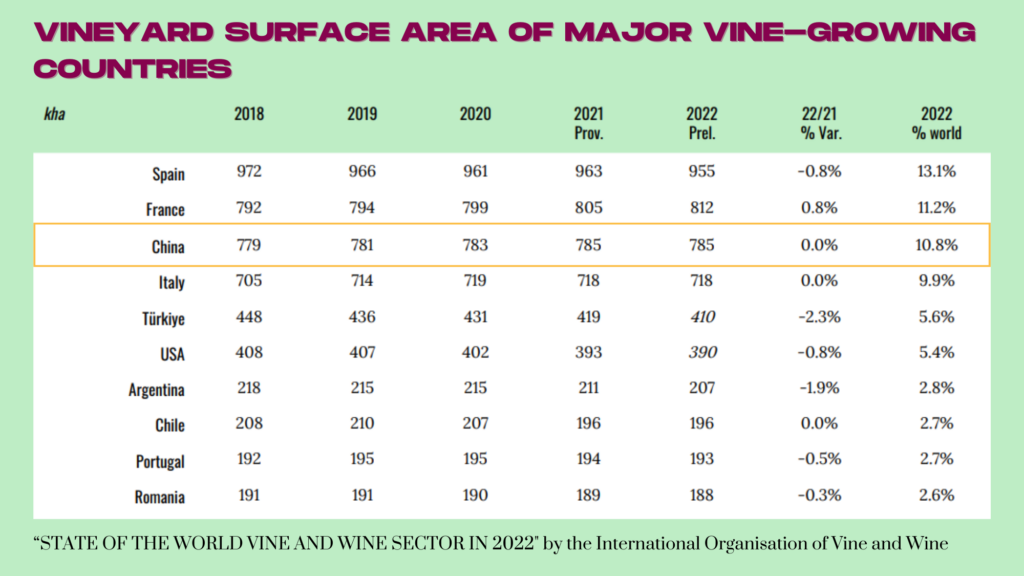

China ranks as the third country globally in terms of land area dedicated to wine viticulture. While a rudimentary form of winemaking was introduced in the 1500s, the effects of economic reforms in the 1980s brought grape varieties and technologies, mainly from France.

While it seemed for years that the wine sector could grow steadily, analyzing data from 2018 to 2022 reveals a consistent decline in production, reaching a total production of 4.2 million hectoliters with a 29% reduction in 2022 compared to the previous year.

Countries Exporting Wine to China

Understanding the Chinese market can be challenging for Western producers, given that government management can lead to rapid and drastic changes. This is evident in Australia, which dominated the market until 2020 with a 40% share. In November 2020, the People’s Republic government imposed initial tariffs ranging from 107.1% to 212.1% on wine exports (varied by company). In March 2021, additional tariffs increased to 218.4%, causing a decrease in the value of Australian wine exports by AUD 2.08 billion. This decision was driven by the Chinese perception that Australia was selling inexpensive wines in the country. Today, Australian wine represents only 3% of total consumption in China.

The market share left vacant has been occupied by French wines, which grew by 48%, with Bordeaux remaining the most sought-after. Chile also ranks among the top three importers but operates in the mid-to-low product range. Italy is third among wine importers in China, although with more modest results. A significant aspect for Italian wine in China is the increase in the average price per liter: +14.67%, reaching $5.14, though still far from the per-liter prices of French wines.